The Golden Era where China was the profit engine has ended with the emergence of world-class Chinese competition. This has been the result of a deliberate, long-term strategy, often called the “Borrow, Imitate, Innovate” model. Chinese companies operating with a “blitzscale” mentality and with relentless cost optimization have created a zero-sum game forcing profits down for both themselves and multinationals. This article offers a road map for transfer pricing in China based on market involutionary forces. While involution can justify allocating less profit to China for transfer pricing purposes, this could be a risky proposition because tax audits have increased (and tax preferences rescinded) since local governments in China are facing severe fiscal pressures.

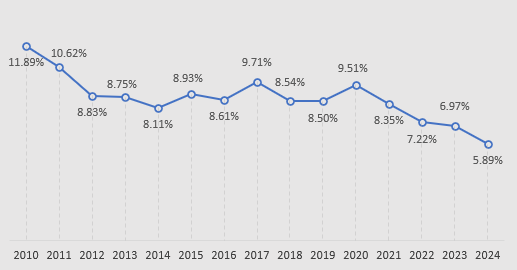

American companies in China identify local competition, along with market slowdown and geopolitical tensions, as a huge concern. The worldwide auto industry is a prime example —of the 10 leading pure electric vehicle (“EV”) companies examined, eight are Chinese, and only three (BYD, Tesla, and Li Auto) are profitable. This involution, known in Chinese as nèijuǎn, has impacted legacy companies such as Ford, which has seen its market share in China plunge from 4.8% in 2015 to 1.6% in 2024, and General Motors, which has taken a charge of more than $5 billion against its businesses in China.

We share profitability data from the American Chamber of Commerce in China (the “AmCham China”), the European Union Chamber of Commerce in China (the “EuroCham”), and our own in-depth research of the performance of Chinese-listed companies. We discuss the surge in audits caused by cash pressures at local governments, the use of Golden Tax Phase IV, and how to achieve tax certainty via advance pricing agreements (APAs). We also share the latest statistics on APAs in China, the US, and Japan.

American Companies in China

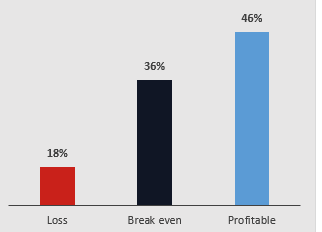

According to the survey data from AmCham China, less than half (46%) of American companies in China are profitable, 36% are just breaking even, and 18% are in a loss.

Financial Performance of American Companies in China in 2024

Source: AmCham China, China Business Climate Survey Report 2025: The American Chamber of Commerce in China (Jan. 2025), p. 5, Fig. 10.

American companies in China are not only facing declining profit margins but also revenue growth. While in the past, the China economy grew at 8% a year, the new normal is about 4% to 5%. In 2024, according to the World Bank, China real GDP grew at 5%, and consumption is still sluggish. World Bank. GDP growth (annual %) – China (accessed on Nov. 5, 2025).

According to the AmCham China survey, “Compared to 2023, responding companies generally have a weaker expectation for 2024 revenue from China operations. 34% anticipate revenue growth, 5% less than the year before; 36% of the companies expect to achieve the same revenue; while 30% expect to see a decrease, with a 2% increase from 2023.” AmCham China, China Business Climate Survey Report 2025: The American Chamber of Commerce in China, p. 23, Fig. 9 (Jan. 2025).

European Companies in China

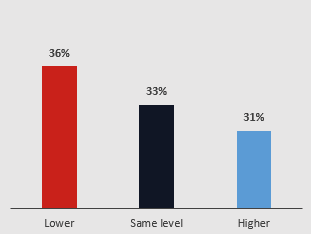

A similar downward trend is evident among European companies in China. Only 31% reported that their profit margins in China exceed their global average. In contrast, the largest cohort (36%) reported an Earnings Before Interest and Tax (“EBIT”) margin in China that was lower than their worldwide performance.

Profit (EBIT Margin) Comparison: European Companies in China vs. Global Average (2025)

Source: European Union Chamber of Commerce in China. Business Confidence Survey 2025: European Union Chamber of Commerce in China ( May 28, 2025), p. 6, Fig. 6.

Declining Profitability by Foreign Companies

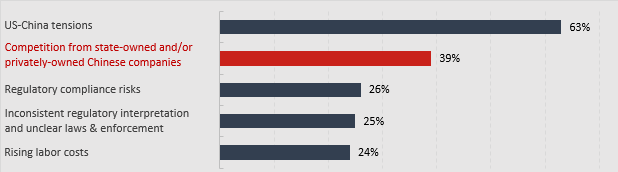

Intensifying competition from local players is emerging as a primary challenge for foreign businesses in China. According to the latest survey, 39% of the American companies expressed their rising concerns about the competition from state-owned and/or privately-owned Chinese companies. This challenge was ranked 4th in 2021, out of top 5 in 2022 and 2023, ranked 5th in 2024 and jumped to the second position in 2025.

Major Challenges Selected by Surveyed American Companies for Their China Business in 2025

Source: AmCham China. China Business Climate Survey Report 2025: The American Chamber of Commerce in China, p. 7, Fig. 15 (Jan. 2025)

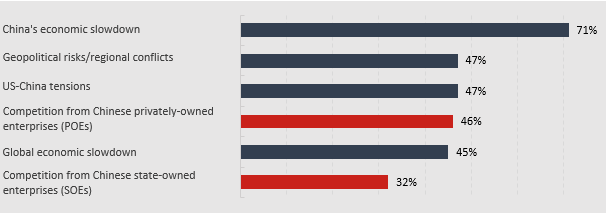

This trend is mirrored in Europe, where 46% of companies report significant pressure from private Chinese competitors, and 32% express concern over the growing influence of state-owned enterprises.

Major Challenges Selected by Surveyed European Companies for Their China Business in 2025

Source: European Union Chamber of Commerce in China. Business Confidence Survey 2025: European Union Chamber of Commerce in China, p. 5, Fig. 3 (May 28, 2025).

China EV Industry

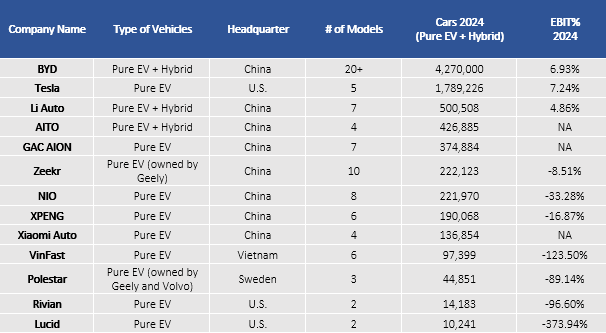

Tesla is no longer the world’s leading EV company. Its market share has plunged and its profits have declined. BYD is now in pole position, with the largest volume and 20+ models. But Tesla is still profitable, while almost all the other pure EV companies are in a loss.

Global Leading EV Companies

Note: We did not include legacy automobiles such as Toyota, Volkswagen, and General Motors who also sell EVs.

Profitability of Global Leading Pure EV Companies (2024, EBIT%)

New Normal for Benchmarking

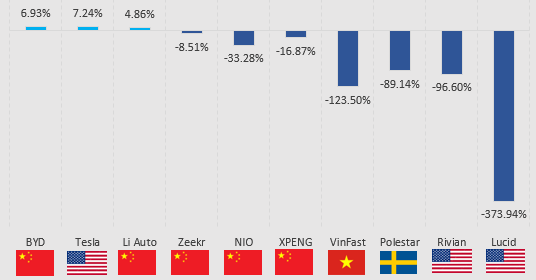

Dentons has performed an extensive, long-term profit tracker for Chinese companies. The median profit rate of the companies in China has gone down from 11.89% in 2010 to 5.89% in 2024, which is a 50% decline over the past 15 years.

Companies should consider reassessing their transfer pricing policy that was established 15 or more years ago. For example, if a policy of cost plus 5% was established, the policy can now be reassessed to 3%. And if a distributor margin of 3% was established, the margin can now be reassessed to be reduced to 2%.

Median EBIT% Trend of Chinese Listed Companies

Source: Financial information extracted from Bureau van Dijk (BvD) OSIRIS database (software version 213.01 updated on Oct. 22, 2025).

Approach to Defend Loss-Making

China has long taken a position that single-function companies must make a profit. This principle is formally articulated in Announcement of the State Administration of Taxation on Promulgation of the Administrative Measures on Special Tax Investigation, Adjustment and Mutual Agreement Procedures (State Administration of Taxation Announcement [2017] No. 6).

Given that more American companies in China now are in a loss position, the question is, “How can these companies defend themselves?” Companies must demonstrate that:

- If at all possible, they are not single-function companies but operate in multiple functions with third-party transactions and that they not only have downsides, but also, in theory, financial upsides.

- The loss is a cause not by changes in transfer pricing but are primarily a result of the market dynamics, created by new Chinese competitors–including privately-owned enterprises (POEs) and state-owned enterprises (SOEs)—and also by the creative destruction caused by the market involution.

New Audit Regime

While involution can justify allocating less profit to China, this could be a risky proposition because tax audits have increased (and tax preferences rescinded) since local governments in China are facing severe fiscal pressures. Key reasons for the cash deficits are:

- Property Market Crisis: Local governments have historically relied on revenue from selling land-use rights to property developers.

- High Debt Burden: A significant portion of their current revenue now goes to servicing this existing debt, leaving less for daily operations and public services.

- Economic Slowdown: A slower-growing economy naturally generates less tax revenue.

The increase in audits has been facilitated by the “Golden Tax System Phase IV” which is a best-in-world system of the State Tax Administration (STA)that integrates data from the taxpayer with data from customs and other government agencies. The System uses big data and AI to red flag potential tax violations.

A notable trend is self-audits. Tax authorities identify targets based on specific red flags and issue a notice requiring the taxpayer to conduct a self-inspection and submit a comprehensive report detailing findings and proposed adjustments.

The tax officials have been given revenue targets and are targeting all types of abuses with particular focus on:

- Value Added Tax (VAT) Rebate Fraud: Cracking down on companies that falsely claim rebates;

- Individual Income Tax (IIT) Avoidance: Targeting high-profile, high-income individuals such as celebrities;

- Corporate Income Tax (CIT): Focusing on transfer pricing, unreasonable cost deductions, and the use of “phantom” expenses to reduce taxable profit; and

- The “Informal Economy": Bringing cash-based businesses and the self-employed into the formal tax net have increased.

With regard to transfer pricing audits, these are increasingly sophisticated. The focus is on payments of royalties and service fees and other specific transactions instead of just overall profit.

Achieving Tax Certainty

To reduce profit in China, it is important to first meet the arm’s-length standard set in Law of the People’s Republic of China on Enterprise Income Tax:

“Article 41: With regard to a transaction between an enterprise and its affiliate, if the taxable revenue or income of the enterprise or its affiliate decreases due to in conformity with the arm’s length principle, the tax organ may make an adjustment through a reasonable method.”

In practice, that means tax bureaus must believe that a reduced profit would be acceptable to a third-party and that would best be proved by detailed industry analysis to demonstrate the involutionary forces. However, this analysis alone will not protect a company if there is a tax haven in the value chain. In fact, even if Singapore is in the value chain, the tax bureau feels that Singapore has minimal substance.

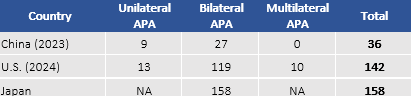

The best protection against an audit is to secure an APA. However, this is difficult and slow in China. Unlike the US and Japan, there is no dedicated APA team. The US program is handled by the Advance Pricing and Mutual Agreement Program, which handles APAs and mutual agreement procedures. The filing fee for an original APAs is $121,600. The APMA Program has about 100 to 120 professionals (including economists, attorneys, and team leaders). Thus, the number of APAs signed in China each year is relatively small compared to that in the US and Japan.

Annual Executed APAs Amount Comparison (China vs. US vs. Japan)

Source: US – the US Advance Pricing and Mutual Agreement Program (“APMA Program”), Announcement and Report Concerning APA (Mar. 27, 2025), p. 4. ; Japan – National Tax Agency, Japan, Mutual Agreement Procedures (“MAP”) and Bilateral Advance Pricing Arrangements (“BAPA”) Report 2024, p. 2.; China – STA, 2023 China APA Annual Report (Dec. 26, 2024), p. 69-71.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law, Bloomberg Tax, and Bloomberg Government, or its owners.

Author Information

Dr. Glenn DeSouza is a Senior Partner and National Transfer Pricing Leader and Evan Yin is a Senior Associate in Tax at Dentons’ Shanghai office.

Write for Us: Author Guidelines

To contact the editors responsible for this story: Soni Manickam at smanickam@bloombergindustry.com;