New tax credits enacted by the Inflation Reduction Act would allow federally recognized American Indian tribes more control over their energy resources, says Quarles & Brady’s Pilar Thomas.

For the first time, federally recognized American Indian tribes would be able to use the tax code and newly enacted clean energy tax credits to secure financing and reduce costs for the deployment of renewable energy and other clean energy projects on tribal lands.

This historic change in the tax code would give tribes game-changing opportunities to fully participate in the clean energy transition, whether on a small or larger scale. There’s no limit on the dollar amount of the tax credits for commercial scale renewable energy projects. However, the proposed rule places limits on tribes’ ability to partner with other entities to co-own clean energy projects.

The IRS recently published its proposed rule for implementing Section 6417 of the Inflation Reduction Act. The elective pay provisions authorize tribes, as applicable entities, to elect to receive the full value of tax credits through a direct payment refund from the IRS (direct pay).

The IRS proposed rules have further expanded eligibility for tribes to include tribal government agencies, instrumentalities, and political subdivisions (such as tribal housing authorities, tribal utilities, tribal economic development authorities, or other tribal government entities). It is still unclear if tribal enterprises are eligible, but updated guidance published last week authorizes tribal enterprises to own projects eligible for the additional tax credits.

Key tax credits tribes can access are substantial:

- Between 30% and 70% investment tax credit for renewable energy projects (solar, wind, geothermal, storage, interconnection), which includes a bonus tax credit for projects located on American Indian lands or that serve tribal housing and residences.

- Up to 30% for alternative fuel refueling property, such as electric vehicle charging stations (with limits), carbon oxide sequestration projects, qualified commercial electric vehicles (with limits), and advanced energy manufacturing facilities.

- Up to $3 per kilogram for clean hydrogen production.

- Up to 3 cents per kilowatt for solar or wind energy production.

With direct pay, tribal governments would be eligible to claim and receive a payment from the IRS equal to the amount of tax credit. This payment would be made after the project is placed in production, so it serves as a refund (rebate) and not as a grant.

This would require the tribal government to pay for projects upfront, which they can do by borrowing money from the federal government, state government, or private lenders. Alternatively, tribes can partner with a third-party developer or investor to fund the development or co-own the project.

In addition, the tax credits and direct pay would give tribes more options to participate fully in the clean energy economy and energy transition. There’s no limit on the dollar amount of the tax credits for commercial scale renewable energy projects such as solar, wind, and geothermal energy production. Tribes can now participate for the first time as either sole or joint owners of such projects.

Tribes interested in large-scale commercial projects would still likely need to partner with experienced developers who can bring required expertise in project development or with investors who can contribute the substantial up-front capital needed to develop and construct projects. The IRS proposed rules, though, would limit tribes’ ability to structure these partnerships.

The IRS would have tribes co-own projects through “tenancy-in-common” or unincorporated joint venture—structures the IRS understands but not tribes. Hopefully, the IRS will reconsider the severe limitations it’s placing on tribes and other applicable entities to be able to partner with others to develop and deploy clean energy projects on and near tribal lands.

One key provision in the proposed rules would allow tribes to leverage both grants and tax credits for clean energy projects. This provision is critical for tribes—especially for smaller tribes that lack financial resources, and thus are heavily dependent on grants—to pay down the cost of clean energy projects that will serve the tribal community.

This includes rooftop solar, community scale solar, wind (which results in more energy savings and reduction in greenhouse gas emissions), or microgrids (which would provide energy resiliency and mitigate the impacts of climate change on the tribal community). In some cases, the total cost to a tribe can be zero.

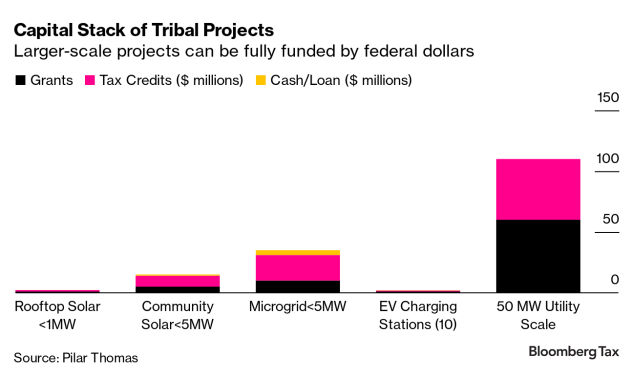

Combined with some of the newer programs in the tax and climate law, such as the USDA forgivable loan program (with loans up to $100 million) or the Department of Energy Rural and Remote program (with grants up to $100 million), even larger scale projects can be fully funded by federal dollars. The following is an example of the “capital stack” of tribal projects—leveraging grants, loans, cash, and tax credits.

Tribes are also eligible for the clean hydrogen and carbon sequestration tax credits. Tribes are evaluating clean hydrogen project opportunities, and some have joined the DOE regional hub efforts.

These tax credits create an opportunity for fossil fuel tribes to leverage their conventional energy resources to participate in the energy transition. Further, tribes with substantial clean energy resources (solar, wind, geothermal, hydroelectric) can find a new green hydrogen market for their clean energy resources.

For the longest time, tribes have sought ways to fully control the development of their energy resources and to protect their sovereign rights and authorities over their clean energy opportunities. Many tribes also have explored their opportunities to leverage energy resources for economic development, job creation, and revenue generation. These new tax credits, combined with direct pay, can contribute to the financing of large and small projects and would be a major tool in achieving those objectives.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author Information

Pilar Thomas (Pascua Yaqui) is a partner at Quarles & Brady. She advises Native American tribes and renewable energy developers on tribal renewable energy project development and finance, tribal economic development, federal Indian law, and natural resource development.

We’d love to hear your smart, original take: Write for us.