- Hundreds of thousands of identity theft tax cases remain under review

- Many taxpayers with frozen returns could still be expecting refunds

The IRS still struggles to contact taxpayers whose returns have been flagged over identity theft concerns, the National Taxpayer Advocate said in her mid-year report.

Victims of identity theft also face years-long delays in getting their refunds, with a backlog of 387,000 cases still stuck in review as of April 15, Erin Collins said in the Wednesday report. And the IRS hadn’t received a response to about 1.5 million requests for taxpayers to verify their identity by the close of filing season.

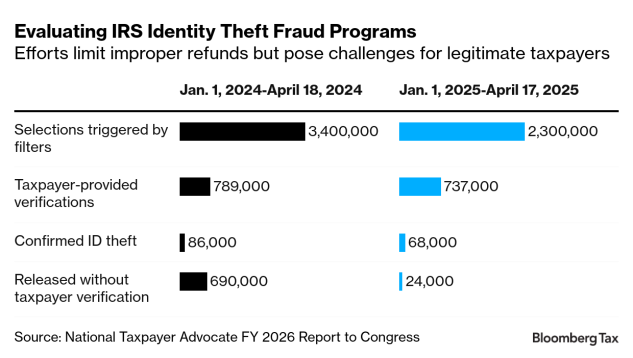

The IRS uses a filtering system to flag returns that may indicate identity theft. It then sends them to the Taxpayer Protection Program, which attempts to verify the taxpayer’s identify. Better filters this year sent fewer false positives for review, said the taxpayer advocate, who runs an independent office inside the IRS.

The TPP reaches out to these taxpayers by letter instructing them how to verify their identity. But the IRS is only required to send one letter, and it can often lack “clarity,” the taxpayer advocate said in her report. Many of these letters go unanswered and their corresponding refunds unclaimed, the report said.

Contacting taxpayers has long been a challenge for the TPP. In a sampling study during tax year 2020, the IRS estimated that only about 7% of taxpayers flagged for possibly improper refunds responded to requests for identity verification. The IRS determined that year that almost 50,000 cases were legitimate claims for which the agency had frozen funds because of missing responses, according to that sample study.

When the IRS does confirm identity theft, it investigates these cases and resolves them before approving a refund. But it takes an average of nearly 20 months to get a refund back to a taxpayer who was a victim of identity theft. Year after year, the backlog of identity theft cases piles up. Now, 387,000 of them remain unresolved, the taxpayer advocate said.

To contact the reporter on this story:

To contact the editors responsible for this story: