- Transatlantic merger creates Big Law’s fourth-largest firm

- Top law firms growing at fast rate as profits soar

A&O Shearman is Big Law’s newest player, but the transatlantic firm still faces challenges to truly join the legal industry’s elite.

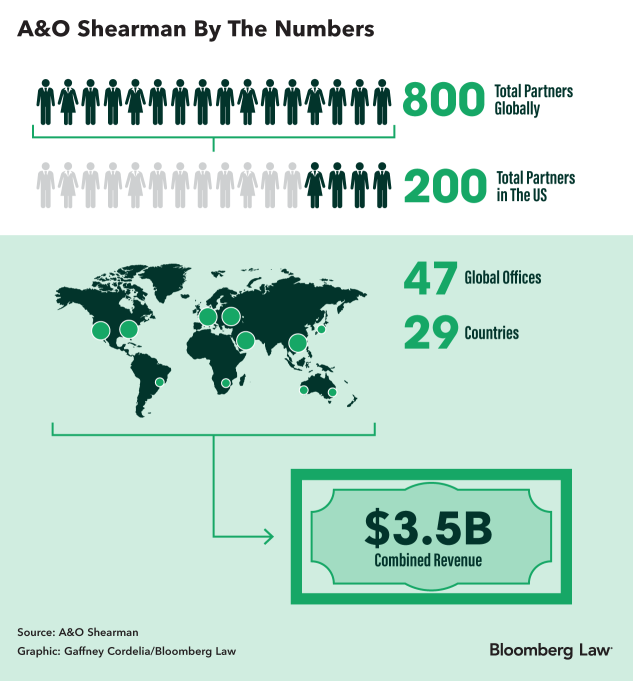

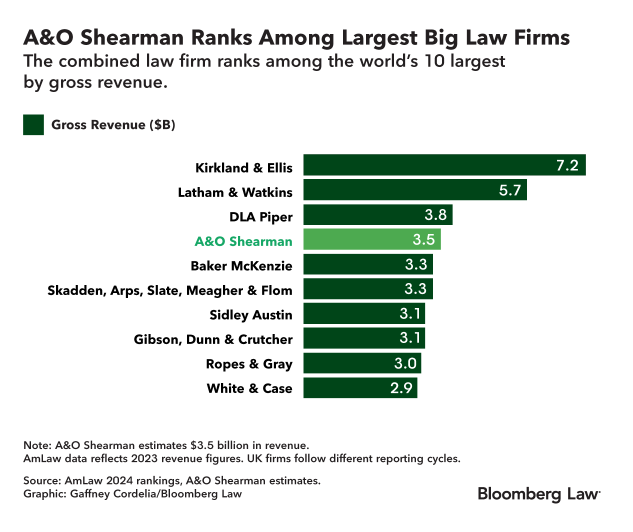

The merger of London’s Allen & Overy and Manhattan’s Shearman & Sterling, which became official Wednesday, creates the world’s fourth-largest law firm, with $3.5 billion in annual revenue and 4,000 lawyers. The deal gives A&O access to the lucrative US legal market and offers a lifeboat for Shearman, which had lost key lawyers and failed in previous merger talks.

It comes amid a stretch of consolidation among major law firms racing to keep pace with fast-growing competitors.

Even with its partnership, A&O Shearman still lacks the deep roster of private equity lawyers seen as necessary to rival top competitors, like Kirkland & Ellis and Latham & Watkins. Those firms and others have watched profits spike as they gobble up deals lawyers with promises of massive pay raises.

The transatlantic merger is the first combination of major US and UK firms in more than a decade. The tie-ups have proven difficult to pull off thanks to competing pay systems, cultures, and governance structures.

“The next two or three years are going to need a lot of care and attention around integration of the two firms,” said Siobhán Lewington, a partner at search firm Macrae in London.

The jury is still out on the wisdom of some London-based firms to poach Wall Street lawyers and roll out new stateside offices in recent years.

A&O Shearman’s leaders tout its reach, with boots on the ground in 29 countries.

“Our global clients increasingly are looking for an integrated legal solution, ideally from one firm, to support them in their global ambitions,” Khalid Garousha, senior partner of A&O Shearman, said in an interview.

US Play

The merger will be judged largely based on how the combined firm performs in the US, the world’s largest market for legal services.

A&O Shearman’s US presence is expected to generate $1 billion in revenue and includes approximately 200 partners, according to the firm.

Adam Hakki, senior partner at Shearman, will helm the firm’s US business as stateside chair, the No. 3 role firmwide. He also will serve as co-chair of A&O Shearman’s global board and executive committee.

Hakki is a New York litigator who was tapped to lead Shearman after merger talks with Hogan Lovells disintegrated. He has handled big ticket court fights involving Bank of America, Morgan Stanley, and Paramount Global, among others.

Shearman brings to the table an M&A team that has advised CVS, JetBlue, and SAP SE in recent years as well as a highly regarded energy transactions team in Texas.

But the firm has seen its revenue plummet in recent years, as deals work slowed and partners headed for the exit. Its revenue dropped more than 17% from over $1 billion in 2021 down to $837 million last year.

UK firms have struggled to make inroads in the US market, a hot spot for M&A, private equity, and other deals work.

Some of London’s elite “Magic Circle” firms—a group that includes A&O, Freshfields, Linklaters, Clifford Chance, and Slaughter & May—have made significant investments stateside, hiring away lawyers from top Wall Street players and other rivals. Others have largely stayed on the sidelines.

“Linklaters is invisible here, and while Freshfields has made a number of high-profile, high-price lateral hires, the jury will be out for several more years on whether their efforts will have lasting market-leading impact,” said Bruce MacEwan, president of Adam Smith, Esq., a firm that consults with law firms on strategic and economic issues.

Clifford Chance has been working to build out a US presence for 25 years since the firm’s merger with New York’s Rogers & Wells, a tie-up seen by many as failing to deliver. The 2000 combination was the last time a London “Magic Circle” firm merged with a US competitor until the A&O Shearman deal.

“The question becomes, do they want to go deeper than just the Linklaters, Freshfields charts, or do they want to compete with the big American firms” said David Barnard, founding partner at law firm consultancy firm Blaqwell, Inc. “The former is possible, the latter is a wish.”

Private Equity Puzzle

A&O Shearman will need to carve out a larger private equity practice to make a real dent in the US market.

“We’re willing to invest in this area to make sure that we have the depth and reach to compete at the highest level,” Hakki said of private equity in an interview.

The combined firm’s global reach could be a strategic advantage, he said. It will allow the firm to compete for more work from clients the individual firms have already advised in some parts of the world but didn’t have the capabilities to serve in other parts, according to Hakki.

The firm’s private credit practice may help buoy it in the meantime, as alternative lending deals continue to spike. Total private credit assets are expected to reach $2.2 trillion by 2027, according to London-based investment data company Preqin Ltd.

“A&O’s private credit initiative led by [Stephen] Lloyd is something they are doing well and in a very organized and coordinated way,” said Macrae’s Lewington.

Modified Lockstep

Allen & Overy, the much larger of the combining firms, has installed two of its own in the top leadership roles.

Khalid Garousha, A&O’s regional managing partner for the Middle East and Turkey and interim global managing partner, will helm the new firm as its senior partner. He’s joined by Hervé Ekué, a Paris financial services lawyer who will serve as managing partner.

The duo replaces two longtime A&O executives who have since left the firm: Wim Dejonghe and Gareth Price.

They face the complicated task of leveraging the strengths of each firm. That means melding cultures and pay systems—which vary widely between US and UK firms—and combining resources. It also means recruiting and retaining lawyers in an era in which partners are increasingly willing to jump to the highest bidder.

“We are going to be competing at the highest level for the most complicated work,” said Hakki. “We need to be competitive from a compensation point of view, and we intend to be.”

A&O Shearman will operate under a modified lockstep with flexibility in terms of the compensation ladder and the top end. It will also have a bonus structure.

Shearman & Sterling managed to keep its core US roster fairly intact, even while seeing notable departures in other regions. More than 30 partners have left the firm in the year since the merger was announced, according to data from Pirical.

“That’s the risk that you run whenever you do a merger,” Barnard said.

“When the merger takes as long to reach finality as this one,” he said, “you can be sure that every headhunter on the street is looking to extract from both firms the people who have the best portable business.”

—Rose Walker contributed to this report

To contact the reporter on this story:

To contact the editors responsible for this story: