- Treasury will stop issuing paper checks beginning in October

- Business visitors, Native Americans among groups possibly affected

The Treasury Department is set to realize a long-held goal at the end of September when it stops issuing paper checks for tax refunds, but it may come with unintended consequences.

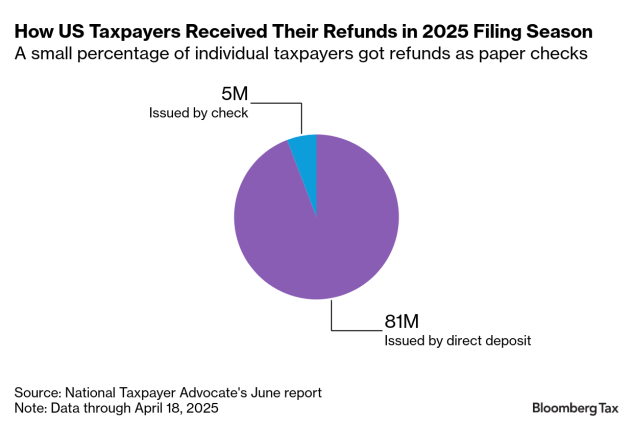

How it meets that target, with an abrupt end after sending out at least 5 million paper refund checks this year alone, will leave some taxpayers confused or without refunds, tax and consumer advocates said. The effort has been bolstered by an executive order signed by President Donald Trump.

About 94% of taxpayers who received refunds during the 2025 filing season through mid-April got them via direct deposit, according to a June report from the national taxpayer advocate. Moving the remaining American taxpayers away from paper has been a priority for the Treasury and IRS for years, but the agencies have approached this goal gradually.

But following a March 25 executive order that cites fraud risks around paper payments, Treasury is set to simply stop issuing paper checks Sept. 30. The order also directs Treasury to process all payments electronically “as soon as practicable.”

The end of paper checks could hurt low-income, elderly, and rural taxpayers who can’t or won’t get direct deposit into a bank account and might be forced to resort to financial products that have their own fraud challenges. And the speed at which the Treasury will wind down paper payments leaves some observers unsure as to how the department will pull off the transition.

“There’s absolutely no way,” said Samantha Galvin, director of the federal tax clinic at Loyola University Chicago. “It probably needs to be phased in.”

Treasury representatives didn’t respond to requests for comment.

Near-Term Problems

The problems could start soon after the September deadline, as extended and quarterly returns come due on Oct. 15, said Nina Olson, a former national taxpayer advocate who is now executive director of the Center for Taxpayer Rights. There isn’t nearly enough time to alert all those planning to file on paper to the change, Galvin said.

There are old refunds that still need to be paid, too, such as those that had been frozen over identity-theft concerns. Some of those returns, likely years old, undoubtedly requested payment by paper check, Olson said.

“Where do the refunds go?” Olson asked. “You’re not issuing paper checks. Does the money just sit there until somebody, a taxpayer calls and says, ‘Where’s my refund?’”

The executive order includes several exemptions to its mandate for electronic payments, including for “individuals who do not have access to banking services.” But it might be difficult to determine who really needs those carveouts as there’s limited data about who relies on paper, Olson said.

“There’s just been an assumption that people don’t want to—that they like checks—rather than exploring what populations want checks,” Olson said.

Varying Reasons for Checks

Treasury solicited stakeholder feedback in May, seeking more information about barriers preventing taxpayers from receiving electronic payments from the federal government. Responses suggested there are a wide range of taxpayers who could struggle with the move, with each group having their own specific reasons for challenges.

Individuals who could struggle to get electronic payments include those who don’t have enough money to open bank accounts or elderly people who aren’t comfortable using online payment systems. Numerous Native American communities submitted responses, arguing that electronic payments could be difficult for members of tribal communities who live in rural areas and without reliable internet access.

Survivors of domestic violence could have their refunds fall into the hands of their abusers, especially if they still maintain a joint bank account, said Galvin and Carla Sanchez-Adams, a senior attorney for the National Consumer Law Center.

Other types of taxpayers could struggle, too. The American Institute of CPAs urged Treasury to exempt trust and estate income tax filings until tax forms for those groups can be updated with a place to enter direct deposit information. Short-term businesses visitors without US bank accounts also could face challenges, according to AICPA and KPMG.

“Even though the reasons are varied, the point to be made is that, at the end of the day, people still choose to receive payment by check,” Sanchez-Adams said.

Treasury also received comments from financial firms pitching their products as electronic alternatives to paper checks. Trump’s order directs Treasury to transition to these types of alternatives, like prepaid cards or a non-bank online payment system, to reach taxpayers who don’t have bank accounts.

But using that technology, especially if rushed to consumers, could increase risks of fraud or lost payments, Sanchez-Adams said. Her organization’s comment letter said it’s easier to commit large-scale fraud online than by stealing individual checks.

“It will move vulnerable people to electronic products that are, frankly, predatory,” Olson said.

To contact the reporter on this story:

To contact the editor responsible for this story: